Many investors are currently wondering…

“What’s the next catalyst for market movement after the brutal sell-off in volatility recently?”

Well, the upcoming May 3 FOMC meeting is not priced as a major market mover.

But there is a vol narrative starting to emerge ☟

↓

↓

σ With the market pricing an 83% probability of this being the last Federal Reserve hike of the cycle, it certainly would not be a shock if confirmed on May 3.

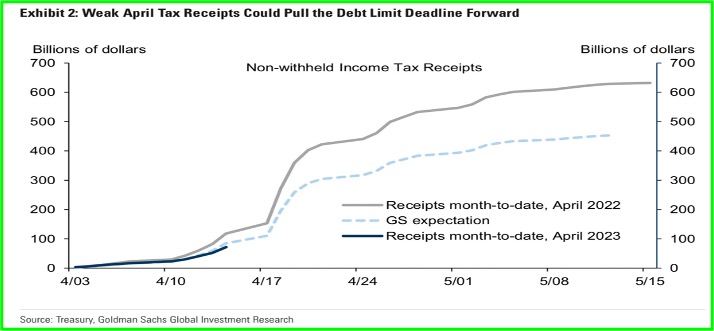

However, a story to keep an eye on is the US debt ceiling deadline.

Originally thought to be in August, it may now be brought forward due to low tax receipts in April.

↓

↓

If Congress is forced to settle the issue sooner than anticipated (and with Republicans playing hardball and demanding $4.5Tn in spending cuts), the market may get nervous about a potential shutdown.

While past occurrences have been eventually resolved, the political theater may create some volatility.

↓

↓

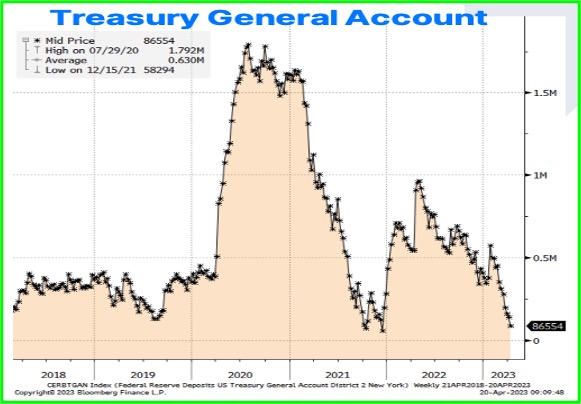

σ You also have the TGA getting rapidly drawn down recently. An often cited leading reason for some of the market’s recent strength.

However, it’s getting dangerously close to zero…

This could give investors cause for concern regarding liquidity.

↓

↓

Overall, we’re not expecting a massive vol spike, as these issues are known.

But at these oversold levels of vol, the risk-reward of being short isn’t great.

↓

↓

➠ Stay vigilant and keep an eye on these potential vol event catalysts by watching this clip from today’s Macro Options Spotlight ↴

Watch today’s full Spotlight to also see:

• Recap of yesterday & overnight price action

• Today’s Cross Asset Vol Summary

• Credit credit crunch is coming, and spreads look too tight

• HYG Volatility Dashboard & $HYG trade idea

σ

σ

σ

➠ Ready to continue taking your trading and options education to the next level?

We can help!

We’ll be holding our first Options Trading Bootcamp of the year on April 29-30.

➠ A virtual deep dive into the world of options, with a syllabus & teaching to strengthen your options game no matter your experience level.

There’s no better time to learn how to profit from volatility than right now.

PLUS – Anyone who enrolls get’s complimentary access to the Options Insight bundle subscription.

➠ We, unfortunately, have a limited amount of attendees allowed on the call at once, so click the link below to register ASAP ↴

Q2 2023 OPTIONS TRADING BOOTCAMP

Q2 2023 OPTIONS TRADING BOOTCAMP

σ

σ

σ

➠ Thank you for making it this far!

Please share this with anyone you know who may be concerned with incoming volatility in markets.

Cheers!

Imran Lakha

Options Insight